Structured Settlement Companies save you ever found yourself wondering what to do after winning a lawsuit or getting an insurance payout? It’s not always as glamorous as it sounds. Sure, a large sum of money sounds exciting—but managing it wisely? That’s a whole different story. That’s where Structured Settlement Companies come in. But which ones can you really trust? Today, we’re pulling back the curtain and revealing real examples of structured settlement companies that people have actually used—plus what makes them stand out.

This guide is for everyday people like you and me who want straight answers without all the financial jargon. So, let’s dive in.

1. Introduction to Structured Settlements

Imagine receiving a large amount of money from a lawsuit. It’s exciting, yes, but it can also be overwhelming. That’s where structured settlements step in—they’re like the “slow drip” of financial stability. You receive regular payments over time rather than a one-time lump sum, helping you manage your funds more responsibly.

2. What Are Structured Settlement Companies?

Structured Settlement Companies help individuals sell part or all of their structured settlement payments for immediate cash. Why? Life happens—emergencies, home repairs, starting a business, or even paying for college. These companies act as a bridge between your long-term payout and your current needs.

Think of them like a pawn shop—but instead of your jewelry, you’re selling future money.

3. Why People Choose Structured Settlements

Here’s the thing: life isn’t predictable. People often opt to sell structured settlements because:

- They need immediate cash

- They want to invest in a business

- They’re facing medical expenses

- They want to pay off high-interest debt

It’s about turning “later” money into “now” money—just wisely.

4. Real-Life Example #1: J.G. Wentworth

You’ve probably heard their jingle: “It’s my money and I need it now!” That catchy tune isn’t just advertising—it represents one of the most well-known structured settlement companies in the U.S.

Why people choose J.G. Wentworth:

- Decades of experience

- Clear, easy-to-understand process

- No hidden fees

- Nationwide coverage

Real user story: Sarah from New York sold part of her annuity to pay for her son’s college. She said the process was “surprisingly simple” and called customer service “top-notch.”

5. Real-Life Example #2: Peachtree Financial Solutions

Peachtree has been in the game for over two decades, known for personalized service and flexible options.

What makes Peachtree shine:

- Custom payout plans

- Consultation with financial advisors

- Focus on long-term client relationships

Real user experience: John, a small business owner, used Peachtree to fund his new restaurant. “They helped me understand every step,” he noted.

6. Real-Life Example #3: Fairfield Funding

Fairfield is a smaller but highly rated company known for competitive quotes and fast service.

Why it works:

- Direct communication with decision-makers

- Better rates due to lower overhead

- No pressure tactics

Case example: Amanda, a single mom, needed a down payment for a home. Fairfield offered her a fast quote and funds within three weeks.

7. Real-Life Example #4: Stone Street Capital

Stone Street Capital has been helping people with annuities and structured settlements for over 30 years.

Standout qualities:

- Solid reputation

- Clear contracts

- Excellent customer reviews

Client story: Marcus, a veteran, used Stone Street to cover moving costs and medical bills. “They treated me like a person, not a number,” he shared.

8. Real-Life Example #5: SenecaOne

SenecaOne blends technology and service, offering a fully online process for added convenience.

Why choose SenecaOne:

- Quick turnaround

- Digital application process

- Options for partial payments

Real story: Kelly used SenecaOne during the pandemic to cover lost wages. “It saved me from falling into debt,” she said.

9. What Makes a Structured Settlement Company Trustworthy?

Let’s face it: not all companies are created equal. Here’s what separates the real deal from the sketchy ones:

- Transparency: No hidden fees or confusing terms.

- Licensing: Registered in the states where they operate.

- Experience: A long, positive track record.

- Client reviews: Real people, real experiences.

- Court approval process: They walk you through it.

It’s like choosing a doctor—you want someone reliable, with a good bedside manner and a great reputation.

10. How to Avoid Scams in the Industry

Sadly, there are wolves in sheep’s clothing. Watch out for:

- Guaranteed approvals (there’s always a court process)

- No written contracts

- Pushy salespeople

- Unrealistic offers

Pro tip: If it sounds too good to be true—it probably is.

11. Key Features to Look for When Choosing a Company

Don’t just go with the first name you hear. Look for:

- Flexible options for full or partial buyouts

- No-pressure consultations

- Competitive payout rates

- Speedy processing

- Legal support for court appearances

Choosing a company is like buying a car—you want performance and peace of mind.

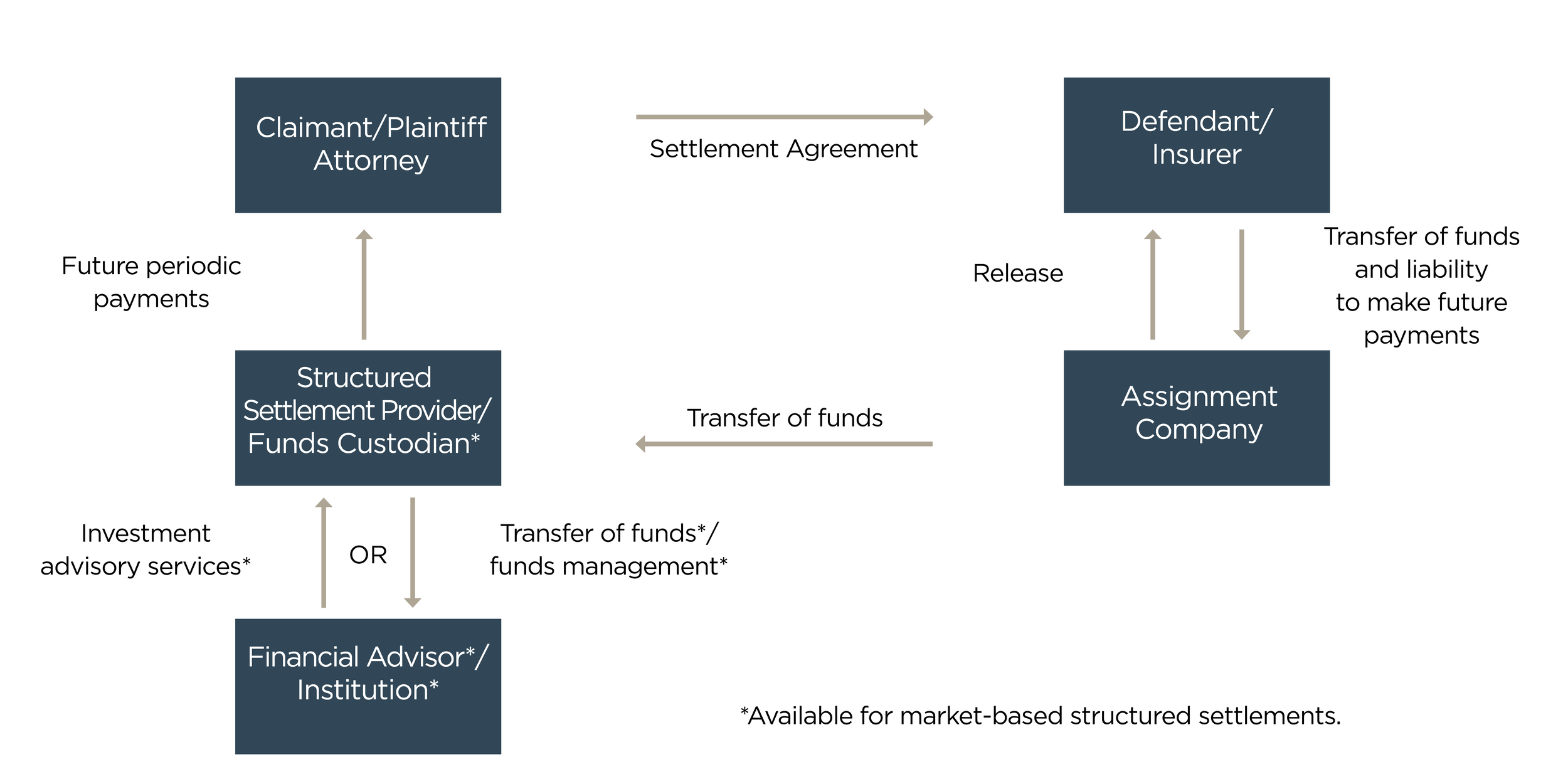

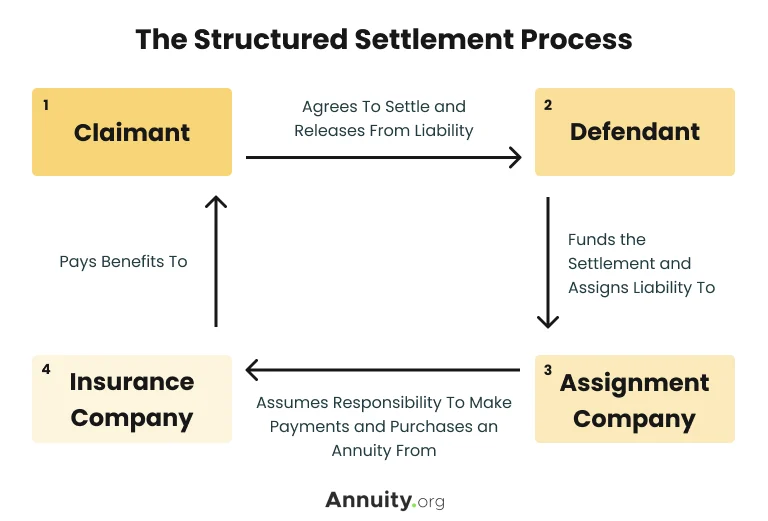

12. The Process: From Quote to Cash

Ever wonder how it all works? Here’s a basic rundown:

- Initial contact – You reach out for a quote.

- Evaluation – They assess your payment schedule and offer.

- Agreement – You sign a contract.

- Court approval – A judge must approve the sale.

- Payout – You get your funds, usually via direct deposit or check.

Timeline: Usually 30 to 90 days.

13. Pros and Cons of Selling Your Settlement

Pros:

- Immediate cash

- Ability to invest or pay off debt

- Greater financial flexibility

Cons:

- You lose future payments

- May receive less than total value

- Court approval can be time-consuming

It’s like trading in a long-term savings account for a lump sum—good in some cases, risky in others.

14. When Selling Makes Sense

Here are some common scenarios when it’s actually smart to sell your structured settlement:

- Medical emergencies

- Business investment

- Home purchase

- Paying off high-interest debt

- Education costs

Ask yourself: Is the benefit today greater than the loss tomorrow?

15. Final Thoughts and Tips

Choosing from among Structured Settlement Companies isn’t just a financial decision—it’s a life decision. These companies aren’t miracle workers, but for the right person in the right situation, they can be a lifeline.

Tips before you commit:

- Shop around for quotes

- Read every contract carefully

- Talk to a lawyer or financial advisor

- Ask for references or testimonials

Your future is worth protecting. Make sure you trust the people helping shape it.

16. FAQs

1. What exactly does a structured settlement company do?

They help individuals sell future settlement payments in exchange for a lump sum of cash today.

2. Is it legal to sell a structured settlement?

Yes, but court approval is required to ensure it’s in your best interest.

3. How long does the process usually take?

Typically 30 to 90 days, depending on state laws and court schedules.

4. Will I lose all my future payments?

Not necessarily. Many companies offer partial buyouts, so you can sell some payments and keep others.

5. How do I know if a company is legitimate?

Check for licensing, reviews, transparency, and make sure they follow legal court processes.